Chapter 4: Rolling Choices - Risk and Reward

The previous chapter included the words “uncertain,” “unknown” and “unpredictable” a combined total of eleven times. While the wording varied, the message remained constant. One of the most central ideas when investing is the uncertainty of what will happen in the future.

Defining Risk

Some investments fail. Companies compete to address the same need of the same client, and in most cases, only one can win. One business is built assuming the future will look a certain way, and another is built assuming it won’t. As a result, investments fluctuate in value as the uncertain world ahead comes into better focus. If the future that benefits your investments doesn’t happen, there’s a risk that you could lose money.

Ultimately, what matters to you as an investor is whether you reach your goal or not. For example, you may have a goal to save $30,000 in three years for a down payment on a house. If you set aside $10,000 each year for the next three years into a savings account, you know with certainty that you’ll reach your goal. There’s no risk your investment will decrease in value and that you’ll miss your goal. If, however, you invest the $10,000 each year in stocks, you face the risk of losing money and not having enough for your down payment.

Exhibit 11 – Uncertainty results in a risk that some investments will lose money. If you lose money, you may not achieve your goal.

Different investments carry different levels of risk. Often, they’re separated into two categories of low risk and high risk.

Low-Risk Investments

An example of a low-risk investment is a savings account at a bank. The chance that the bank won’t have the exact amount of money that you expect when you withdraw is extremely low. Because the interest rate is known and the bank guarantees your deposit, you’re assured that when it comes time to take out your money, you’ll have what you expected.

High-Risk Investments

An example of a high-risk investment is buying a stock. When you buy a stock, you receive ownership of a portion of a business. Over time, the business earns money, releases products and gains or loses customers. As a result, the value of your portion of the business fluctuates up and down with good and bad news. Because the future value of that stock is unknown, there’s a risk that when you sell it, you won’t receive enough money for your goal.

We’ll cover the stock market further in Chapter 12. To summarize, your stock can increase or decrease in value over time with no guarantee of your initial savings. If you pay $20 for a stock and over five years the company does well, your investment may be worth $40. However, if the company struggles, the stock may only be worth $10. The factors that determine how these investments perform are mostly unpredictable, which is why there’s a higher level of risk.

Accepting Risk for a Reward

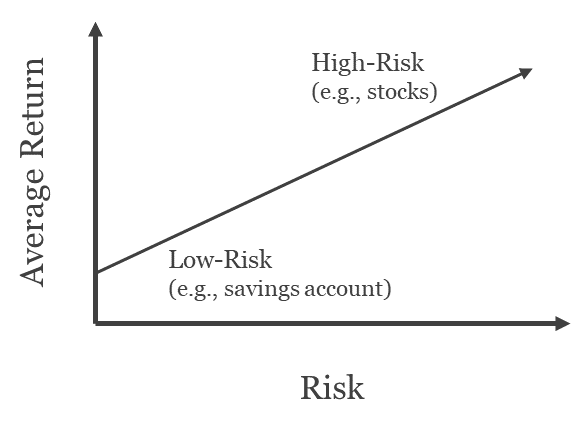

Very few people enjoy taking on risk for the fun of it. If there’s a chance an investment will fail, then there needs to be a significant payoff if it does work out. Otherwise, you’re better off investing in something with a more predictable future. Therefore, riskier investments demand a higher return.

To illustrate, savings accounts that have very little risk offer low interest rates relative to other options. If you’re willing to take on more risk and lend your money to a company or government, you can earn a higher interest rate. And if you’re comfortable with the risk of buying stocks, you have the potential to earn even higher returns.

Exhibit 12 – To incentivize you to take on more risk, investments must offer additional reward in the form of higher average returns.

In Chapter 2, we saw that compound growth, especially through higher growth rates, is critical to achieving your goals. Riskier investments, like stocks, are one way people have historically earned these higher growth rates.

Risk and Reward When Building a Snowman

When you’re building a snowman, the primary risk is that you don’t finish in time. This could be caused by a snowball cracking or crumpling.

In a backyard or field, there are plenty of ways to work with friends and family to build a snowman. Each option has pros and cons and will differ in how quickly you reach your goal.

For example, wouldn’t it be great to push a snowball down a steep hill, allowing gravity to do all the work? As the snowball accelerates and picks up more and more snow, it would be hard not to grin with satisfaction. But this approach could end in sorrow if the snowball were to split in half on a hard bounce or collision with a tree. This is where the trade-off between risk and reward comes in. While the reward of successfully rolling the snowball down the hill is substantial, it also carries significant risk.

The decisions required to grow your savings are like the options available when building a snowman. There’s an option to take a less risky path and grow your savings slow and steady over time. Or, through taking on additional risk, there’s an opportunity to grow your savings at a faster rate. As we’ll see shortly, there are several important things to consider as you decide whether to take on risk to help you grow your savings.

Managing Risk

As we saw in the last chapter, the closer you are to needing your money, the more dangerous risky investments are. If your investments suddenly decline in value, it could leave you vulnerable. The little time remaining may not be enough for your investments to grow back to the amount you need. While risk becomes less desirable as you near your goal, we’ve seen that earning higher returns is important. Since low-risk investments don’t offer the returns required to take full advantage of compound growth, it’s common to invest in some high-risk investments.

One strategy is to accept higher risk when there’s plenty of time for your money to recover from any decline in value. While most investments carry risk, the amount decreases the longer the investment is held. Historically, the longer the investment period, the lower the chance of a loss. Therefore, many people invest in riskier investments early in the savings process and gradually switch to less risky investments as the need for the money approaches.

A Tale of Two Snowmen

To demonstrate why it’s important to consider your timeframe when deciding to take on risk, let’s consider two instances of building a snowman.

The first is a group of children with only a single recess left before Christmas break. By the end of the thirty minutes, they hope to have a snowman built to show visiting relatives. The children will likely be quite careful with their actions and may favour a smaller, more stable snowman. They’ll want to be sure nothing goes wrong with such limited time left. These children are in a similar situation to someone investing for a short period of time. For example, if you have a vacation planned in six months, there’s little time available to recover your money if a riskier investment decreased in value.

The second group of children we’ll consider has an entire weekend free of chores and homework. Their hope is to build a snowman that’s the envy of the neighbourhood. They experiment with rolling techniques, knowing full well some will fail. They stack snowballs precariously on top of each other in hopes they’ll stand tall. Their reasoning is quite simple. Through accepting higher risk, they stand a better chance of creating a snowman the size of which they’ve never seen. After all, with a great deal of time to recover from cracked or fallen snowballs, they’d be wasting potential opportunities by sticking to a safe and standard build.

Gradually Lowering Your Risk

The second group of children start with a full weekend ahead and a willingness to accept higher risk. However, as they work through Saturday and early Sunday, they gradually take on less risk in their tactics. The simple reason is that if the snowman fell over on Sunday afternoon, they’d have little time to recover before bedtime.

To demonstrate how this transition works with your investments, we’ll use a brief example. Let’s consider a recent college graduate named Katelyn, who’s twenty-two years old. Her retirement is so far off she likely hasn’t even started thinking about what it will entail. However, with such a long time period, any savings she puts toward retirement will have the chance to recover from an initial decline in value. Because of this long timeframe, Katelyn may find it’s best to put most of her retirement savings in higher-risk, higher-return investments.

A split of 90% high risk and 10% low risk could allow her savings to grow at a faster rate in the early years. As time passes and retirement approaches, the amount of risk she desires will begin to decrease. At age thirty-five, she may determine that 75% in high-risk and 25% in low-risk investments is more comfortable. Once Katelyn reaches the age of sixty, she’ll likely find a more conservative split of 50% high risk and 50% low risk to be most appropriate. This trend toward lower-risk, or more stable, investments continues as her need for the money approaches.

Exhibit 13 – Katelyn gradually reduces the percent of her high-risk investments, preferring low-risk investments as the need for her savings approaches.

The Right Level of Risk

The first step to managing risk—described through Katelyn’s story above—is to make a choice about your ability to handle risk given the time remaining to your goal. Another consideration mentioned in the last chapter is your emotional comfort with risk. If losing money could cause you distress and potentially cause you to sell your investments, then a lower level of risk may be appropriate. You may become more comfortable over time as you experience the ups and downs of investing and see the power of higher returns.

Maintaining Your Target Risk

Once you’ve determined your starting level of risk, the next step is to check in on your investments from time to time. As we’ve discussed, low- and high-risk investments offer differing returns and differing levels of certainty. As a result, one type of investment may outperform the other and grow at a faster rate over time. If this happens, your starting level of risk can stray off track. If your high-risk investments perform very well, what started as 70% of your money in high-risk investments may end up being 75%. Throughout time, often annually, there’s a need to check your investments to ensure you’re still at the level of risk you intended.

Exhibit 14 – Your target risk exposure was chosen for a reason. Therefore, if your investments stray from your target, it’s common to rebalance your investments from time to time.

This idea of increased growth on only a portion of your investments can also be illustrated in the rolling of a snowball. You start with a round ball of snow. While it rolls through the snow, it doesn’t always grow evenly. The snowball can become disfigured as it collects too much snow on one side or the other. The steps taken to address the inconsistent growth of a snowball are the same as you’d take with your investments. Periodically, you stop, take a moment, smooth out or rotate your uneven snowball and begin again from a balanced state. This process minimizes the chance of a piece breaking off unexpectedly due to its exposed state.

Final Thoughts

You’ve now seen why investments that provide higher returns, which are so crucial in growing your savings, carry higher risk. This risk becomes less attractive as you approach a need for your money. After setting your target risk level, there’s a need to rebalance your investments if you’re off track. These simple steps will help you to increase your returns without taking on more risk than you can handle.

Key Takeaways

Some investments will lose money, potentially placing your goal at risk.

Taking on some risk is required to earn higher returns, which are vital for growing your money.

To manage this trade-off, accept a suitable amount of risk and gradually lower it as your goal approaches.

This blog is a duplicate of the recently self-published book The Snowman’s Guide to Personal Finance available for purchase here.