Appendix: How Much to Save for Retirement

A rule of thumb for retirement savings is to set aside 10% of your income. However, this depends on a long list of inputs, including:

Your current age

Any existing savings

When you hope to retire

Your comfort level with higher-risk investments

For instance, if you plan to retire at sixty-five, you’ll need to save less of your income than if you want to retire at fifty. While the answer to how much you need to save varies, it will help to see a base case, and then, we can continue from there.

A Sample Retirement Savings Plan

We’ll start with a list of assumptions for Olivia, a twenty-five-year-old living in Calgary.

Twenty-five years old

No existing retirement savings

Planned retirement age of sixty-five

Comfortable with riskier investments

With these assumptions, and a few others, we can determine how much Olivia needs to set aside each year for retirement.

First, we need to forecast how much Olivia will earn over her career to see what saving 10% would lead to. Olivia expects to increase her income by 4% a year for the next ten years as she takes online courses and expands her skillset. For the remainder of her career, she expects her salary to increase with inflation at 2%.

Exhibit 47 – Between age twenty-five and sixty-five, Olivia’s income increases from $40,000 to $105,000.

Saving 10%

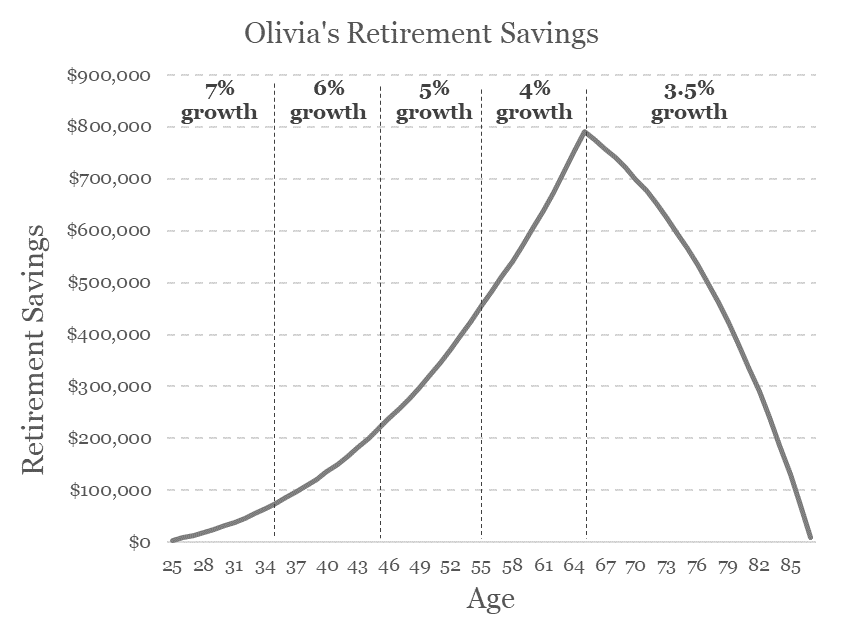

If Olivia sets aside 10% of her income each year, she’d deposit a total of $294,100 to her savings account before retirement. On top of what she sets aside, Olivia could invest her savings to help them grow. Olivia has a long timeframe and is comfortable with riskier investments. Therefore, we’ll assume she starts with mostly high-risk investments before gradually shifting to more low-risk investments.

Exhibit 48 – By investing her money, Olivia could accumulate $790,200 for retirement. She begins earning an average annual growth of 7%, which gradually falls to 4% as she shifts to lower-risk investments.

Savings Compared to Income

In addition to the rule of thumb of saving 10%, you can also look at your total savings compared to your current income. In Olivia’s case, we can divide her savings by her income at each age to see how much she’s accumulated.

Exhibit 49 – The following table shows how many years of income Olivia has in savings from age twenty-five to sixty-five.

Exhibit 50 – Olivia’s case can be simplified to the following table to use as a general benchmark.

Why Save for Retirement

It’s important to save for retirement so you don’t need to dramatically change your lifestyle when you stop working. For instance, if you spend $60,000 a year and leave your job without savings, you’ll need to cut back significantly. You may receive some income from government programs. These include the Canada Pension Plan (CPP) and Old Age Security (OAS) for most Canadians. Low-income individuals may also receive the Guaranteed Income Supplement (GIS). However, this income is rarely enough to support you on its own. As a result, you’ll need savings when you retire so you can continue spending at a suitable level. Travelling, visiting family and maintaining your home likely all require the use of existing savings.

To demonstrate how this works, we’ll continue with Olivia’s situation. As we saw above, with 10% savings, Olivia reaches a total of $790,200 before retiring. Once she retires, she’ll need to use these savings and government pension income to cover her expenses. Since some of her money is going toward savings and costs for her job, she expects her expenses to decline once she retires. For instance, she’ll no longer need to save for retirement or pay to commute to work. Through lowered costs and government pensions, Olivia expects she’ll need $43,000 from her own savings the first year. For simplicity, we’ll assume this continues through retirement, increasing each year with inflation.

Exhibit 51 – If Olivia earns 3.5% growth on her savings during retirement, she’d run out of savings at the age of eighty-seven.

Exhibit 52 – Combining the working and retirement periods shows how savings are used to provide a consistent lifestyle over time.

Other Considerations

Olivia’s case is a simple view that relies on assumptions that may not come true. If her investment returns are lower than planned, she could run out of money earlier. She may also want to consider other factors, including:

How her home value can be used in retirement

Her life expectancy

How much she could lower her spending if required

To give a sense of how these and other factors could impact your retirement plan, let’s review several cases.

Exhibit 53 – If Olivia earns a lower rate of return on her investments, she could run out of savings at the age of eighty.

Exhibit 54 – If she expects to live to ninety-two, she’d need to save 12% of her income instead of 10%.

Final Thoughts

While the rule of thumb to save 10% of your income for retirement is a great start, we’ve seen that each case is unique. As we mentioned in Chapter 6, saving for the future allows you to maintain your standard of living over your lifetime. If you’re able to, saving earlier will provide a great head start. As we saw in Chapter 2 with Daniel and Craig, compound returns are the most useful tool to helping you reach your goal. If you’re starting later than you’d have liked, that’s not a problem, you’re now further ahead than you were yesterday. If your employer offers a retirement plan with matching contributions, sign up as soon as you can. Otherwise, open a TFSA or RRSP and start making regular, automatic deposits. You’ll be amazed how quickly steady contributions add up.

Key Takeaways

Save 10% of your income for retirement if you’re starting early and slightly more if you’ve waited to start.

Aim to have twice your income in savings by forty and eight times your income by sixty-five.

Once you know when you want to retire and what it’ll involve, you can adjust these amounts accordingly.

This blog is a duplicate of the recently self-published book The Snowman’s Guide to Personal Finance available for purchase here.